My First Crypto Bot

Welcome to PrimeAutomation! This guide will help you set up your first automated crypto trading bot in just a few steps.

🧠 Choose Your Strategy

🔗 Navigate to

New Botin the navigation bar ⚙️ ClickAlgo Bots, AI Bots or Grid Bots - we suggest starting with Algo Bots

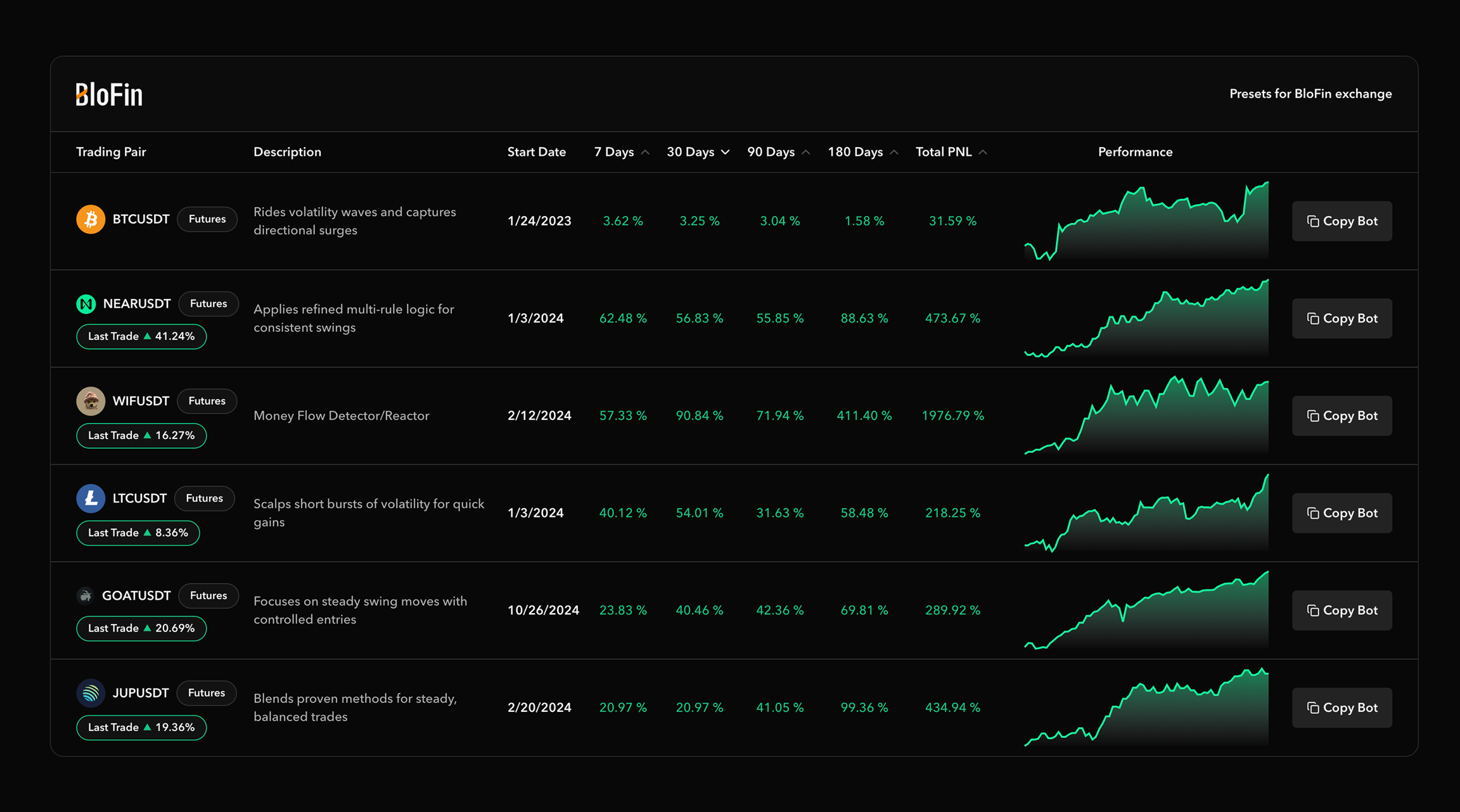

If you clicked Algo Bots, you'll see a list of curated strategies by PrimeAutomation.

All strategies are thoroughly backtested and come with key data points to help you decide.

📊 Strategy Data Shown

Trading Pair – e.g.,

AVAX/USDT,PEPE/USDTDescription – e.g.,

"30m DeLo Bot"or"4h Swing Partials"(timeframe and strategy type)Total PNL (%) – Net profit/loss since strategy inception

Start Date – When the bot began tracking data

Performance Over Time – Metrics over:

1 month

2 months

3 months

6 months

💡 AI-powered strategies

These are marked with an AI icon. They use machine learning to optimize entries/exits and may provide a performance edge. Learn more about the PrimeAutomation AI strategies in the video below:

AI Advantages

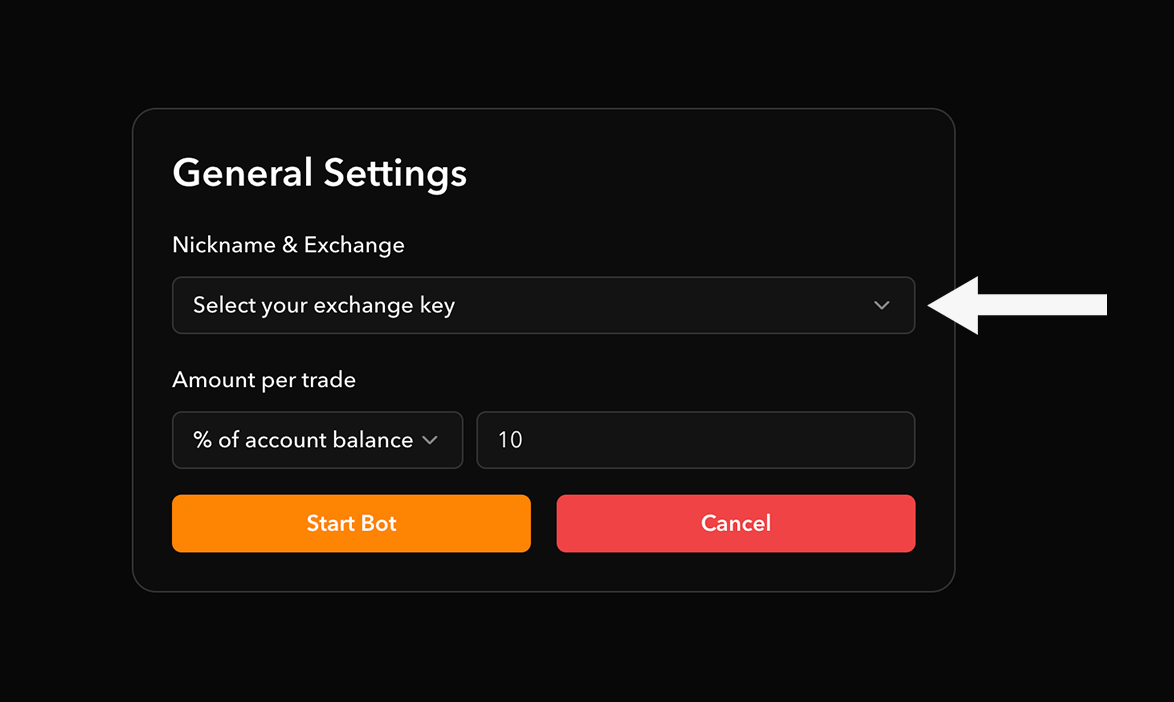

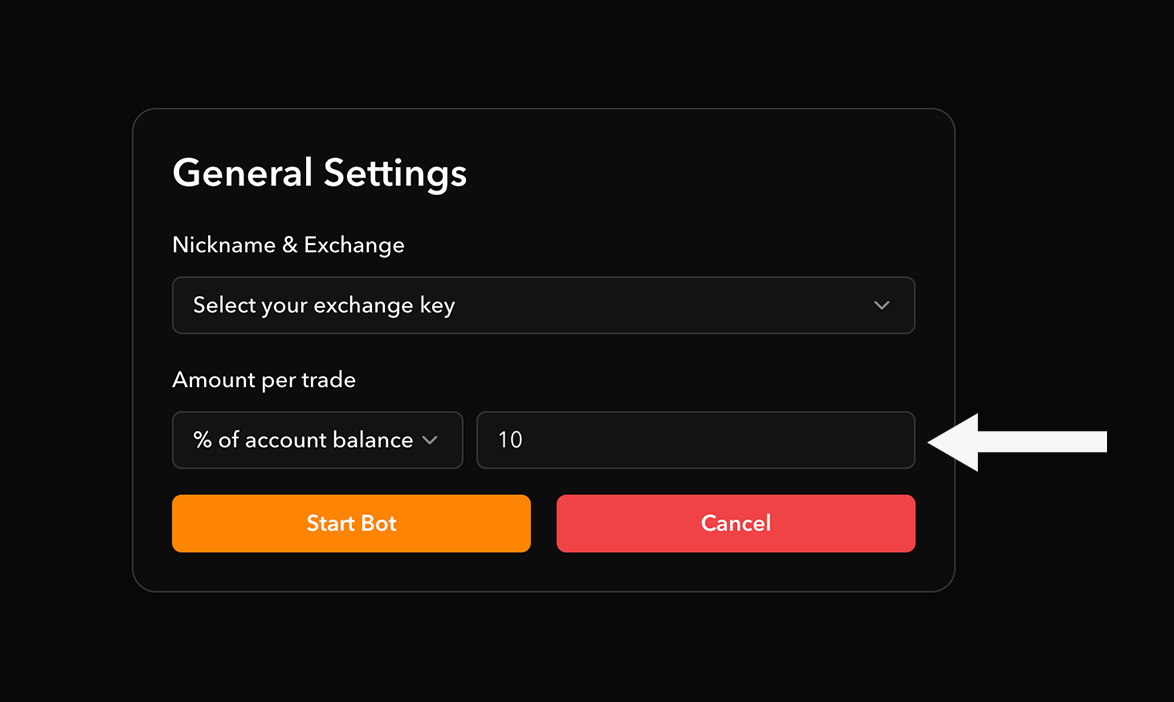

💰 Set Your Investment Amount

Choose how much you want the bot to trade with:

A fixed dollar amount (e.g., $200), OR

A percentage of your balance (recommended ✅)

⚠️ All bots are set to 3x leverage by default, optimized by PrimeAutomation's backtests. 📈 Using a % of your balance allows your position size to scale dynamically as your account grows.

🎉 All Set – You're Now an Automated Trader!

🚀 Navigate to

Dashboardfrom the navigation bar to:

View your live bots

Track PNL

Monitor trades in real-time

Last updated